Mon–Thurs: 8AM–4PM | Fri: 8AM–12PM

BOI Reporting Update

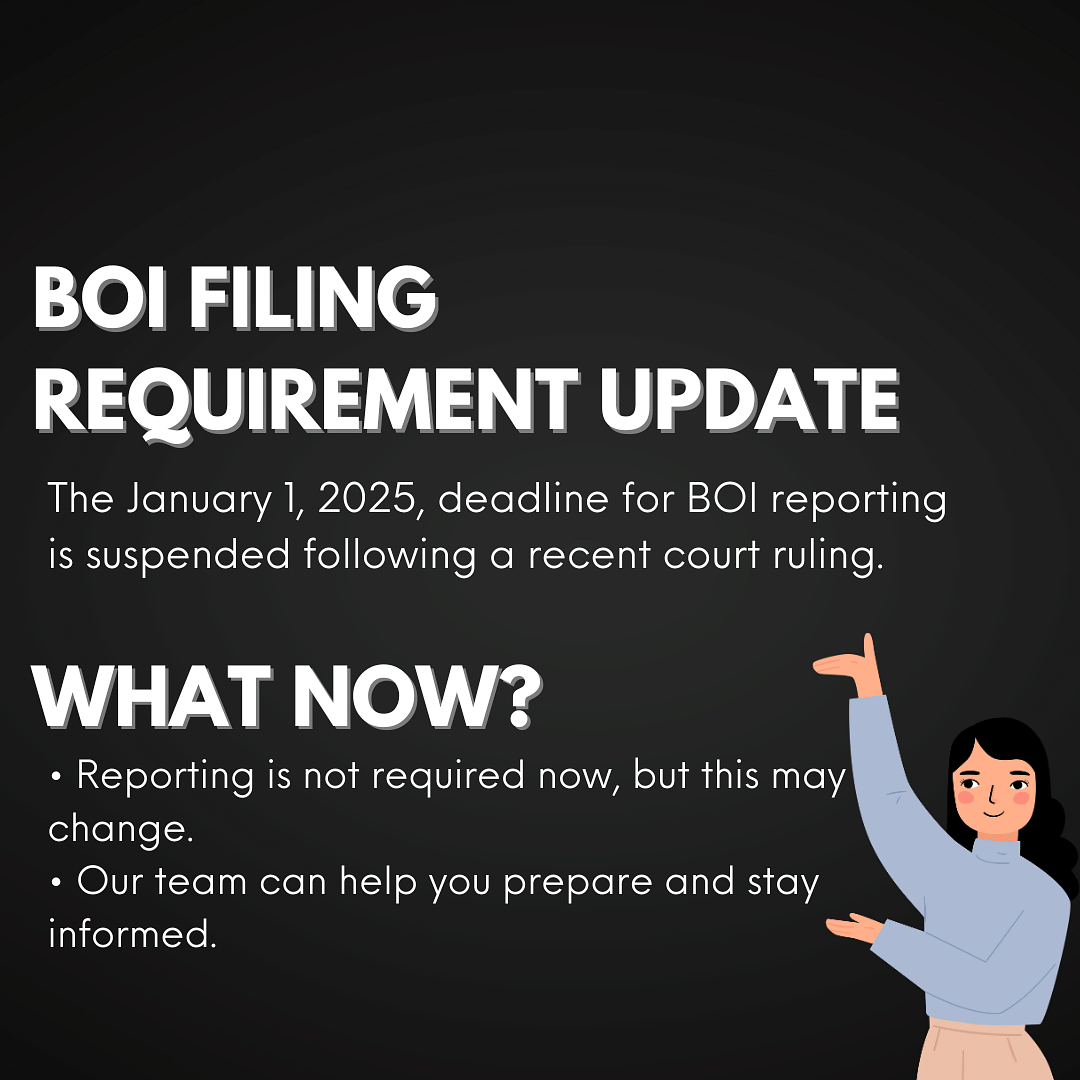

Hi everyone, we're reaching out with a quick update on the Beneficial Ownership Information (BOI) reporting requirements. You might have heard about this new rule requiring businesses to report information about their owners. Well, there's been a bit of a change!

Due to a recent court decision, the requirement to file these BOI reports has been temporarily paused. So, for now, you most likely don't need to take any action to file a report. We know these kinds of changes can be a bit confusing, so we wanted to keep you in the loop.

Even though you don't have to file right now, we still think it's a good idea to be prepared. Gathering information about your company's ownership structure now will make things much smoother if and when the reporting requirements are back in effect. We're keeping a close eye on the situation and will let you know as soon as we have any important updates. As always, please don't hesitate to reach out if you have any questions – we're here to help!